What are Liquidity Pools

A liquidity pool is a designated amount of crypto + USDT that is reserved to help new buyers / sellers get matching orders faster. It's managed by the exchange AMM software, and any fees that would normally go to the exchange are instead given to the liquidity pool.

Basically it's a reserve of digital assets locked within an exchange to facilitate trading. The automated market maker (AMM) algorithms use these assets to construct trades across the Order Book. Users who contribute to the pool—known as liquidity providers—earn transaction fees, helping to maintain market liquidity.

Understanding Slippage

Slippage is the difference between the expected execution price of a trade and the price at which it actually completes. This usually happens during periods of high volatility or when placing large orders that exceed current market depth. By default, trades with more than a 0.5% deviation are blocked unless users opt for Market Trade and set a custom slippage tolerance.

How Liquidity Pools Operate

Liquidity pools reward participants for staking their tokens by distributing a share of collected trade fees. Returns are proportional to each user’s contribution to the pool. For instance, NestEx applies a 0.2% fee on each trade, which is shared among LP holders. Liquidity can be withdrawn at any time, except for the initial stake in a new pool, which is locked to maintain trading stability.

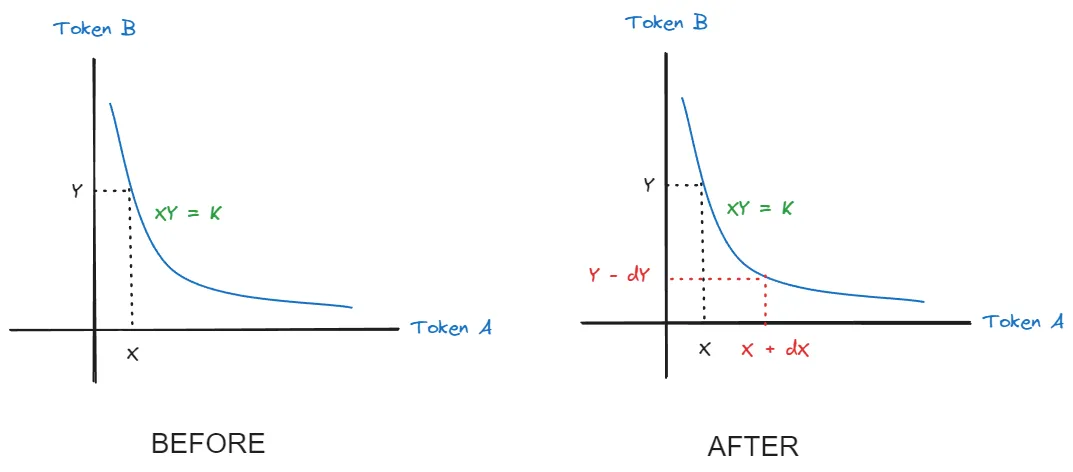

AMMs use mathematical models—like the constant product formula (a × b = c)—to keep token prices balanced as trades occur. If a pool contains 100,000 XYZ and 1,000 USDT, the price is set at 100 XYZ per USDT, and adjusts dynamically with each trade based on supply and demand.

NestEx vs. Decentralized Liquidity Pools (Uniswap, PancakeSwap)

Unlike decentralized exchanges (DEXs) that rely on on-chain smart contracts, NestEx operates as a centralized platform with its own matching engine. This setup eliminates blockchain gas fees when adding, removing, or swapping liquidity. All trading fees—fixed at 0.2%—are passed directly to liquidity providers. In contrast, DEX users may incur additional network charges and are limited to assets available on specific chains.

Market values and Pool strength

Liquidity pools maintain fair market values for the tokens they hold thanks to the AMM algorithms, which maintain the price of tokens

relative to one another within any particular pool. Liquidity pools in different protocols may use algorithms that differ slightly.

For example: Uniswap liquidity pools use a constant product formula to maintain price ratios, and many DEX platforms utilize a

similar model.

This algorithm helps ensure that a pool consistently provides crypto market liquidity by managing the cost and ratio of the corresponding tokens as the demanded quantity increases. NestEx also uses the contant product formula to construct the Order Book, which is basically {primaryLiquidity} * USDT = {constantProduct}. For an individual liquidity provider, the Constant Product does not generally change, however large lop-sided orders may cause a drift in the LP which then gets auto-corrected over time.

Read more

What's new with NestEx

| Buyer | Seller | LP Earns | NestEx Earns | External LP |

|---|---|---|---|---|

| LP | User | 0 | 0 | |

| User | LP | 0 | 0 | |

| User | User | 0 | 0 |